How it works

When you create a stock screening strategy that contains all necessary criteria

and the selected historical year for comparison,

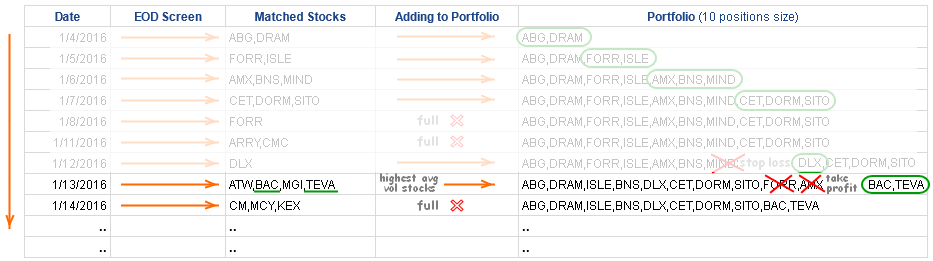

backtesting applies this information and simulates trades for every matched stock based on each day of the selected year.

It operates close prices only, or in other words, it performs end-of-day (EOD) screening to find eligible companies.

Any matching stocks will be put into your virtual portfolio, and any that are not will be ignored. Even if some stocks,

however, do match the criteria, they will still be ignored if there are no vacant positions in the portfolio. Traders

typically do not add a large number of stocks to their portfolio because its purpose is to control risks (20-30 stocks

generally suffice). Portfolio size can be specified along with other parameters during strategy creation. Also, if some

stocks in the virtual portfolio conform to exit criteria, stop loss, or take profit conditions, the corresponding position

will be closed. Users can specify the criteria for closing positions. In this case, stocks that were purchased earlier

are sold and will be reflected in simulated trades.

The position is then closed, which allows for vacant positions in the portfolio:

|

You can select the stock prioritization on the strategy editing page using the Prioritize Stocks by select box. The prioritization can also be specified in the criteria for opening a position set by formulaic expression using the SORTBY function. If the prioritization parameter is not specified, the backtester uses the order in which the tickers are stored in our database. This is primarily alphabetical but still not guaranteed since new IPOs are added to the bottom of the list.

Position size

You can set the position size as either a fixed amount or a percentage. In the case of a fixed amount, the number of shares is always calculated so as not to exceed the specified value, regardless of the current trading balance. For example, if you set the risk per trade to $2,000 and the stock's price added to the portfolio is $95, the backtester will open a position of 21 shares of $1995.

The calculations are more complicated if you set the risk per trade as a percentage of the balance. When there are no open positions, the trading balance is the free cash's size, and the new position's volume is calculated as a percentage of this value. If already open positions exist, they are accounted for in the total trading balance at the market entry price. Even if their market value has changed over time, their value in the virtual portfolio will still be accounted for at the purchase price, the price at which they were added to the virtual portfolio.

Let's consider an example when we have $100,000 initial capital and risk 10% of capital per trade. So when 10 stocks matched the initial entering condition, we have 10 positions at about $10,000 each. Let's say two positions were closed at 50% take profit, and we have $30,000 cash. 8 open positions in the portfolio are taken into account at the market entry price, and this will be $80,000. What size will the positions be when adding new stocks? Since we indicated 10% of the capital, the backtester will only hold up to 10 positions. The basic rule is that there cannot be more than 10 positions. On the other hand, we can only risk up to 10% of capital. This is the second important rule. Therefore, when two new stocks are matched the entering criteria, the backtester will open two new positions with a volume of $11,000 (10% of 110,000). We cannot open two positions of $15,000 each because it turns out that we are risking approximately 13.6% (100% * $15,000 / $110,000).

If those two positions were closed by a 50% stop loss, we would have $10,000 cash and $80,000 shares. In this case, the cash size would be divided equally between the two new positions, and they would be opened in equal amounts of $5,000 each, even if this did not happen simultaneously. Thus, the backtester always follows the rule of 10 positions in the portfolio, will distribute free capital equally when opening new positions, and will not risk more than 10%.

|